Analysis of Governor Hochul’s Budget Proposal: Impacts to Businesses and Local Governments

New York State Governor Kathy Hochul has unveiled her $233 billion proposed budget for FY 2024-25. While we dig through the full details of her budget found within the Article VII budget bills, here is a summary of various taxes and fees, as well as grants to support economic development and local governments.

TAXES

Cannabis Potency Tax: The Cannabis Potency Tax is repealed and replaced with a weight-based tax to simplify tax compliance for distributors.

Tax Compliance Tools: The Tax Department is provided with new tools, and longstanding provisions that bolster tax compliance are extended.

Tax Parity for Vacation Rentals: The budget supports local governments by creating tax parity between hotels and the vacation rental industry. Vacation rental companies like VRBO and Airbnb would be responsible to collect and remit hotel/motel sales taxes to state and local taxing jurisdictions.

Itemized Deduction Limit on High Income Filers: The limit on itemized deductions for high-income filers, in place since 2010, is permanently extended. This move is expected to increase city revenue notably.

Amended Sales Tax Returns: The process and timeline for filing amended sales tax returns are clarified, with the introduction of clear process standards.

Gaming Initiatives: The budget extends various expiring Racing Pari-Mutuel Wagering and Breeding Law provisions and the authorized use of Capital Funds by a certain Off-Track Betting Corporation for one year.

Sales Tax Vending Machine Exemption: The existing sales tax exemption for certain food and drink purchased from vending machines is extended for one year. This exemption aims to incentivize a shift to cashless vending machines that can collect sales tax at the point of sale.

Support for Local Governments: Over $1.2 billion is provided in support for towns, villages, and cities other than New York City, resulting in a net positive impact due to several revenue actions, including the changes to the cannabis potency tax and the inclusion of the vacation rental industry in the tax law.

ECONOMIC DEVELOPMENT

Regional Economic Development Councils (REDC): A central component of the state’s investment and economic development strategy, focusing on a regionally-driven approach to support community revitalization and business growth. The Executive Budget includes significant funding for REDC programs, highlighting their continued importance in economic recovery and growth.

(NEW) Office of Workforce Development: The creation of the Office of Workforce Development signifies a comprehensive effort to enhance the skills and talents of New York’s workforce.

Economic and Community Development Funding: The budget proposes $880 million in new funding across various programs, including $150 million for REDC, $200 million for the Downtown Revitalization Initiative, $400 million for the New York Works Economic Development Fund, $50 million for the Restore-NY Communities program, and $82.5 million for the Olympic Regional Development Authority (ORDA).

Downtown Revitalization and NY Forward: There’s a focus on revitalizing smaller downtowns, with a $100 million investment for rural and smaller communities. The Downtown Revitalization Initiative (DRI) and NY Forward are key programs in this effort, promoting vibrant communities and supporting the state’s agricultural, recreational, and tourism economies.

Tourism Investment: Recognizing tourism as New York’s third-largest employment sector, the budget continues significant investments to support this industry.

ORDA Capital Improvements: The budget allocates $82.5 million for ORDA to enhance Olympic and other ORDA-owned facilities, boosting winter recreation and attracting large sporting events and international championships.

Empire AI Initiative: The state plans to invest $275 million, supplemented by over $125 million from private partners, in the Empire AI initiative. This investment aims to position New York at the forefront of AI research, innovation, and economic development.

Partnership with the State University of New York: A public-private alliance involving major companies aims to establish New York as a leader in semiconductor research and development, supporting the tech economy and creating numerous jobs.

AID TO LOCAL GOVERNMENTS

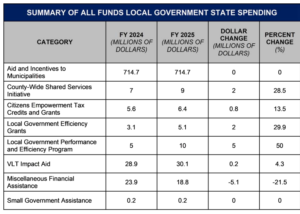

General Purpose Aid and Grants: The Aid and Incentives to Municipalities (AIM) program provides general-purpose aid. Other programs offer small government assistance, miscellaneous financial assistance, and support for municipalities with video lottery gaming facilities.

New County Partnership Grants Program: A $250 million grants program is created to fund shared expenses and promote collaboration between the State and Counties. This includes $85 million to help counties purchase public safety equipment and $50 million for site development preparation grants.

Local Government Efficiency Program: This program provides technical assistance and grants for intermunicipal projects. The FY 2025 Executive Budget increases the number of awards and the maximum award amounts, doubling the total annual funding from $4 million to $8 million.

Citizen Empowerment Tax Credits: These tax credits support cities, towns, or villages that consolidate or dissolve, providing an annual aid bonus equal to 15 percent of the newly combined local government’s tax levy, with at least 70 percent used as direct relief to property taxpayers.

Financial Restructuring Board: This board assists distressed municipalities by conducting comprehensive reviews to develop recommendations for restructuring and improving fiscal stability. It may offer grants or loans to implement these recommendations.

Additional State Spending: The budget includes nearly $57.6 billion in total spending on behalf of local governments through major local aid programs and savings initiatives, an increase of $3.5 billion over the prior year. This includes increases in School Aid, Medicaid, and support for New York City migrant services.

Support for Cities, Towns, and Villages: The budget provides over $1.2 billion in support for towns, villages, and cities other than New York City. This includes several revenue actions like the repeal and replacement of the cannabis potency tax and the inclusion of the vacation rental industry in the tax law.

County Support: State spending on behalf of counties outside of New York City is expected to total over $7.4 billion. This includes significant investments in partnerships with counties for public safety communications systems, infrastructure grants, anti-poverty initiatives, and funding for district attorney offices.

ENVIRONMENT

Clean Water Investment: The budget proposes an allocation of $500 million over two years to support clean water initiatives.

Flood Resiliency Projects: To protect communities from severe floods, $435 million is earmarked for resiliency projects, including a $250 million voluntary buyout program.

Environmental Protection Fund: The budget includes $400 million for the Environmental Protection Fund to support various environmental protection activities.

State Superfund Program: An allocation of $100 million is proposed for the State Superfund Program, focusing on the cleanup and redevelopment of contaminated sites.

NY SWIMS Investment: The budget invests $160 million in NY SWIMS to address the disinvestment in swimming facilities and lifeguards, particularly in underserved communities, and an additional $446 million for State parks and pools.

Tree Planting Initiative: As part of a broader environmental effort, the budget includes $47 million to plant over 25 million trees across New York by 2033.

Affordable Gas Transition Act: This act is included to protect utility customers from the cost of unwarranted investments in fossil fuel infrastructure and to align with the state’s Climate Act.

Renewable Action Through Project Interconnection and Deployment (RAPID) Act: This act aims to streamline the environmental review and permitting of major renewable energy and transmission facilities, creating a one-stop-shop within the Office of Renewable Energy Siting (ORES).

Expansion of Climate Smart Communities Program: The proposal includes increasing the maximum grant award for this program to assist localities in addressing economic, social, and environmental issues. Currently, state assistance payments are capped at fifty percent (50%) or $2 million. This amendment would authorize DEC to provide up to eighty percent (80%) – or $2 million – in grants to municipalities that meet the criteria for financial hardship or for being a disadvantaged community.